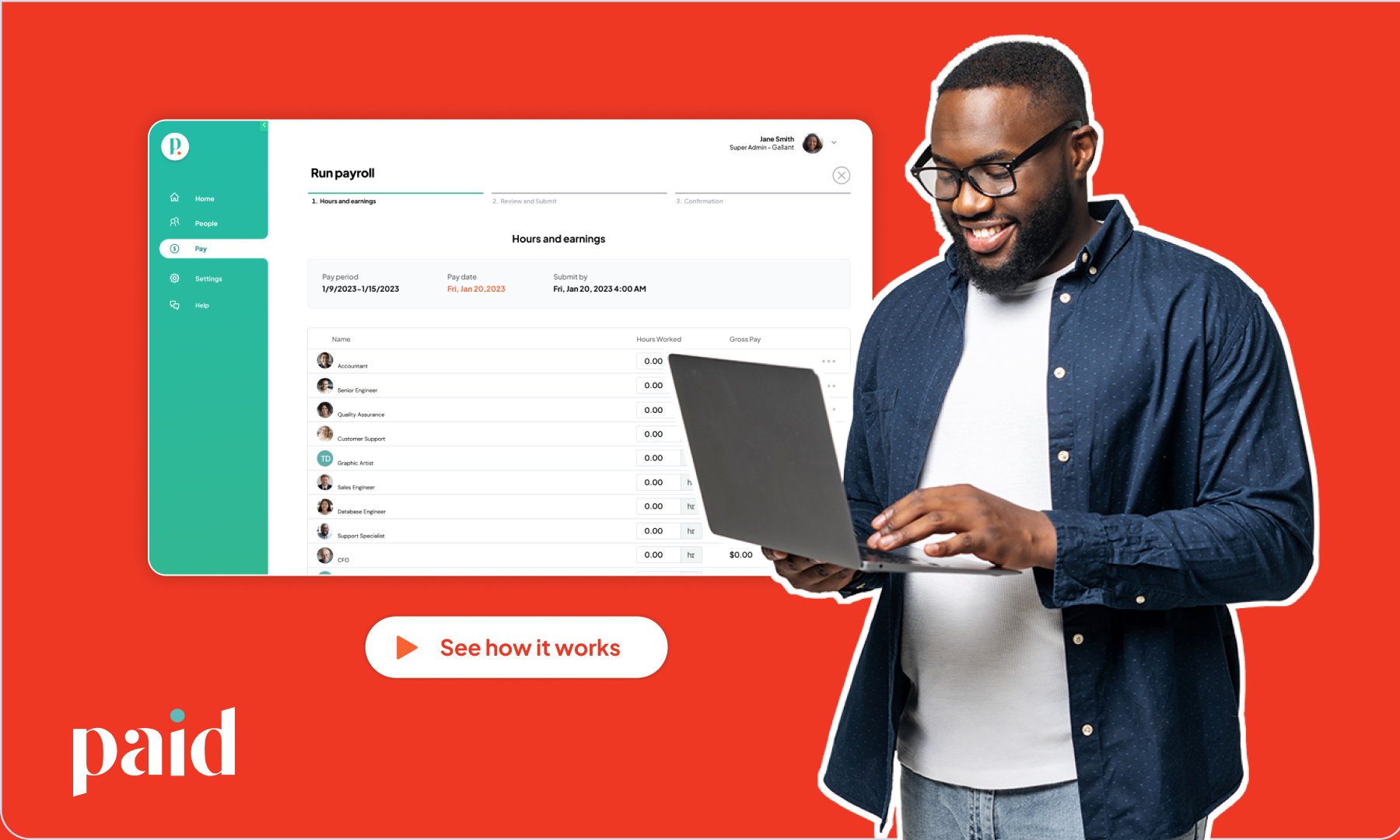

Running payroll shouldn’t feel like running a marathon. That’s why we built Paid—a free payroll platform that’s reinventing how small businesses manage cash flow and retain employees. With core payroll services at no cost, Paid has already helped small business owners automate busywork, keep more money in the bank, and give their teams financial perks they’ll actually use.

Now, we’re making Paid even more powerful with the launch of Timesheets, our new time and attendance tracking tool designed specifically for small teams—available now with a free trial for your first two pay runs.

Say Hello to Timesheets 👋

If you’ve ever spent hours chasing down hours (literally), Timesheets is about to be your new favorite tool. With Paid Timesheets, employees can clock in and out, and managers can approve hours with just a few taps. Hours flow straight into payroll—no spreadsheets, no back-and-forth, no errors.

Here’s what makes Timesheets worth it:

- 📲 Real-time time tracking – Clock in and out from their Paid dashboard

- ⏱ Automated syncing with payroll – Approved hours flow directly into pay runs

- 🔄 Fewer errors, faster paydays – No more manual calculations

- 🧑💼 Built for small teams – Manage 3 users for just $25/month (after a free trial)

Whether your team is hourly, hybrid, or fully remote, Timesheets helps you track time, stay compliant, and pay your team accurately—all without lifting a finger. After your free trial, it’s just $25/month for up to three users. View full pricing details here.

And Everything Else is Still Free

While Timesheets is our first paid upgrade, everything else Paid offers is still 100% free—no hidden fees, no per-employee charges, and no complicated plans.

Here’s what you get:

For Business Owners

- Automated payroll with an easy-to-use dashboard

- Built-in tax support (W2s, 1099s, filings, and more)

- State and federal compliance tools

- Simplified employee management, from PTO to benefits

For Employees

- Free Paid Checking account with a 2.50% annual percentage yield (APY)1

- Early access to up to 25% of net pay, 2 days early2

- 3x rewards on debit card purchases and direct deposit3

- Self-serve dashboards for pay transparency

Payroll that Pays You Back

We’re not just making payroll cheaper—we’re making it smarter. With Paid, your business runs leaner, your team earns more, and payday becomes a moment of empowerment instead of a headache.

As Paid co-founder Rob Frohwein puts it:

“Combining free payroll with meaningful rewards for employees not only drives retention—it levels the playing field for small businesses. And with tools like Timesheets, it just keeps getting better.”

Ready to Try Timesheets?

Our Timesheets feature is available now in your Paid dashboard. It’s free for your first two pay runs—and you can view full pricing details here.

---

Paid is a d/b/a of Keep Financial Technologies, Inc. ("Keep"). Keep is a financial technology company and is not a bank. Banking services are provided by Thread Bank, Member FDIC. The Paid Mastercard Debit Card is issued by Thread Bank, Member FDIC, pursuant to a license from Mastercard U.S.A. Inc. and may be used anywhere Mastercard cards are accepted. FDIC insurance is available for funds on deposit through Thread Bank, Member FDIC. Pass-through insurance coverage is subject to conditions. 1. The interest rate on your account is 2.47% with an Annual Percentage Yield (APY) of 2.50%, effective as of 10/01/2024. Rate is variable and is subject to change at any time three (3) months after account opening. Fees may reduce earnings. 2. Employees are eligible to receive 25% of their net pay 2 days before payday with the use of a Paid checking account. Terms and Conditions apply. 3. Terms and Conditions apply to the rewards program. Paid Rewards earned will be credited into your account immediately. ATM transactions, the purchase of money orders or cash equivalents, and account funding made with your debit card are not eligible for Paid Rewards. Please refer to the Rewards Terms and Conditions for more details. Direct deposit requirements apply.

.png)